People often wonder why the United States, the largest economy in the world and a nation world-renowned as a technology and research powerhouse, is not the global front-runner in the race to install renewable energy sources. Solar Choice is keeping a close eye on developments in the North American solar industry, and once we have consolidated our UK operations (www.solarselections.co.uk), plan to be live in the USA within the next two years.

One likely explanation for the USA’s delay in achieving its solar superpower potential may be that it is a nation that has historically been a strong proponent of free markets and averse to government intervention in business. As a result there a mandatory national target for adoption of renewable energy does not exist, while such targets do exist in the EU, Japan, and even Australia. Although the ever-combative political climate in the US makes it unlikely that sweeping renewables legislation will be passed on the federal level anytime soon, there are numerous solar-friendly state policies that are promising steady growth and long-term stability for solar power and other renewable energy sources. It is decentralised, market-based mechanisms will likely be the driving force in future growth.

Germany champions installed solar, China leads in renewable energy investment. Where is the US?

If asked to name the world-leading country in solar power policy and most installed photovoltaic capacity, most people would immediately and correctly think of Germany, which has a justifiably good reputation as a ‘green’ country that has given true priority to the environment and takes its responsibilities seriously. The interesting thing to note, however, is that much of the progress made in Germany has been relatively recent, as Seb Kilborn pointed out in a previous blog entry about the state of solar power in Germany: feed-in tariff legislation, as well as a panoply of investment tax credits and other incentives, came into effect in 1991 as the EEG, but the rate of uptake really didn’t begin increasing significantly until the year 2000. Since then, the market has taken off: with a whopping 9GW installed capacity in 2009, with no sign of slowing down. The number of new installations per year has been increasing dramatically, and the situation seems likely to continue on this track for the foreseeable future, despite scheduled feed-in tariff rate regressions. The EU-wide emissions trading scheme (ETS) adds another level of security to the German solar power industry’s health, and to the health of the renewable energy industry as a whole.

Solar power as one (big) piece of the renewable energy puzzle

Solar power–both concentrating and photovoltaic power–is the poster child for renewable energy: it is clean, simple-looking, has little or no moving parts, and takes advantage of the world’s most abundant energy source and the basis for virtually all life on earth: the sun. However, the sun is not the only renewable source of energy, and solar policy is often lumped in with other renewable energy sources, such as wind power. It is therefore important to take a look at the big picture with regard to renewable energy policy. In many cases the capabilities and qualities of different renewable resources are equal: electricity generation from naturally occurring sources, little or no carbon footprint, little to no pollution. But in many ways they are not: solar power only produces when the sun shines, wind power only when the wind blows. Any ultimate solution to the world’s energy requirement problems will include, but not be limited to, the deployment of solar technologies.

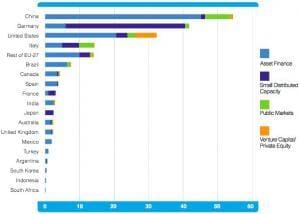

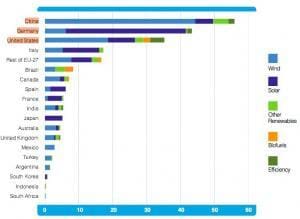

Germany may have a phenomenal lead in installed solar power capacity at the moment (with roughly half the total installed global solar power capacity!), but the world solar industry is moving and changing with amazing rapidity, and it may only be a matter of time before other, more populous countries catch up. China, for instance, according to a report by the Pew Charitable trust (pdf), has as of 2010 taken the #1 spot for renewable energy investment (at about $55B), although the majority of this is in wind power, with only a relatively small proportion going to solar (see tables 2 and 3). It is also important, however, to keep in mind that China is the world’s manufacturing capital for solar photovoltaic panels, thanks to significant government support: it may just be a matter of time before the domestic solar market takes off. Behind China for gross renewable energy investment are Germany and then the United States, which has now managed to slide to third place, down from the top spot 3 years ago.

What is the solar power situation in the United States?

At first glance, it may look like things are not progressing well for the US solar power industry; this is admittedly true considering the size of the US economy. A close examination of the situation in the United States, however, still reveals numerous burgeoning markets for the solar industry, and a complex network of solar power and other renewable energy policies that promises long-term market stability in addition to the robust growth currently being seen there; 9.56MW of solar power was installed in 2010, adding up to a cumulative total of 2.6GW.

A recent report, “U.S. Solar Market Insight 2010 Year in Review“, by the Solar Energy Industries Association and GTM Research, paints a picture of a rapidly expanding solar power industry in the country. Even though the nation as a whole remains behind a number of nations in terms of installed solar capacity (Germany 9GW in 2009, Spain 3.5GW in 2009, France 2.89 in 2009, US2.6GW in 2010, and–for reference–Australia 300MW in 2010), some forecasts predict that the US is on the verge of realising its promise as a world-leader in not only the amount of installed solar power capacity, but also in terms manufacturing and production capacity.

Rhone Resch, president of the Solar Energy Industries Association (SEIA), in an interview with RenewableEnergyWorld.com, commented that the growth that the US is seeing is in all three market segments (see figure 1 at top of the article): whereas the German market is mostly focused on residential, rooftop photovoltaics, and the Italian and Spanish markets on utility-scale concentrating solar power, the US has seen significant growth in utility-scale/industrial, residential, and commercial solar, not to mention in manufacturing. The future is looking bright, and solar power is looking skyward.

Federal Renewable Incentives in the US

As mentioned above, although there have been attempts to do so, the US federal government has not produced legislation to mandate a certain percentage of energy to be sourced from renewables for the nation. The EU, Japan, and Australia have. (The US federal government has set a percentage Green Power Purchase Goal for its own energy consumption–7.5% from renewable sources in the year 2013. The US military is also looking to deploy more solar.)

Nevertheless, there are a number of schemes that have managed to make their way through both houses of congress to become legislation. These can be divided clearly into market- and tax-based incentives (carrots) and standards/requirements (sticks?), the majority of which are targeted at corporations and businesses, taking advantage of the nation’s corporations’ competitive, capitalistic instincts, ideally for the greater environmental good. The corporate incentives on the federal level include tax incentives, tax exemptions, corporate tax credits, grants, and loans. The regulations and policies include energy efficiency standards, building energy standards, the federal Green Power Purchasing Goal, and standards for grid-interconnection for small power generators. There are also personal federal tax credits and personal exemptions for individuals who have installed renewable energy generation units, which includes solar photovoltaics. (For details, see DSIRE: Federal Incentives/Policies for Renewables and Efficiencies.)

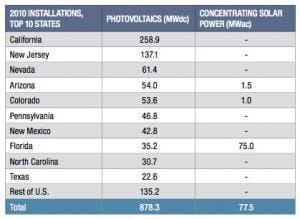

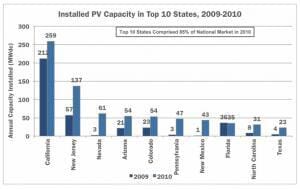

Table 4: Top 10 US states for solar power installed in 2010 (From US Solar Market Insight 2010 Year in Review)

Resilience in Diversity: 50+ policies for 50 states (+2!)

The sort of tax-based policies and incentives that are in place on the federal level can also be found from state to state. But each state, by default less politically diverse than the nation as a whole, has the right to make its own laws, and many have gone ahead and done so. It is on the state level that the real policy innovation is happening, and with 50 of them (+2 with Puerto Rico and Washington DC, plus smaller territories in the Pacific), there is an amazing amount of diversity in the specifics. There are nevertheless a number of similar favoured policies that exist across a number of states. It is this diversity, according to SEIA’s Mr Resch, that will create the conditions necessary for a long-term, stable market for solar power: Even if the plug is pulled on a policy in one state, there will always be other states with strong incentive policies.

Scheming for solar power: Types of solar incentive mechanisms

If you are familiar with Australian or EU renewables policy, then the type of state schemes being employed in the States will be familiar to you. They are roughly summarised below.

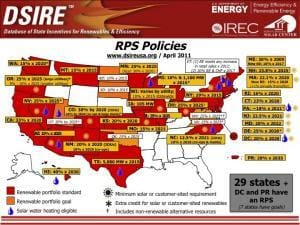

-Renewable Portfolio Standard (RPS): Requires power utilities to source a certain percentage of the electricity that they produce from renewable energy sources. The percentage and target year vary considerably from state to state (many have 20-25% renewable targets by 2020 or 2025), but the vast majority of states do have an RPS (see figure 5). (The Australian version of an RPS is called the Enhanced Renewable Energy Target (eRET). It mandates that 20% of electricity be sourced from renewables by the year 2020.) RPSs are usually driven by the sale of a type of renewable energy ‘currency’, usually called RECs (Renewable Energy Certificates/Credits) or SRECs (Solar Renewable Energy Credits). Generally speaking, in a US state one REC or SREC is generated for each kiloWatt-hour (kWh) of electricity in most schemes, and the the price may fluctuate with supply and demand, although some states such as New Jersey have effective minimum and maximum price mechanisms to stave off excessive market instability, an issue which has recently been in the news here in Australia.

-Feed-in Tariffs/Performance-based incentives: One of the most effective, proven policies for rapid uptake of renewable energy technologies is what is known in Australia and Germany (and some US states) as a feed-in tariff (FiT), in which non-utility, non-commercial electricity generators (usually small-scale at <10kW) are paid by the kiloWatt-hour for their contribution of electricity fed into the grid. With some FiTs it is possible to make a net profit from energy produced, but in many cases only it is only possible to save money on one’s electricity bill–surplus is not credited to the producer. Most FiT policies actively try to eliminate those who seek to sell their electricity with the intention of making a profit. (Likewise, most Australian FiT policies discourage for-profit systems, although it is possible to make a profit in most states.)

There are a number of state schemes in the US that are, in essence, FiTs or quite similar to FiTs but are not necessarily known by the same name. Instead, there is the broader category of ‘Performance-based incentives‘, which may be state-wide, but more often than not are either utility- or county-specific (a ‘county’ is an intermediate level of government between state and local in the US).

-Local and state tax incentives: much like on the federal level, there are a number ways that companies and individuals can save money on their taxes by installing renewable energy generation units, including solar power systems.

-Emission trading schemes (ETS): A carbon tax as a precursor to an emissions trading scheme (ETS) is already under discussion with the current Australian federal government, and

one is already up and running in the EU. In an ETS (also often given the moniker of a ‘cap-and-trade scheme’), there are a limited number of permits to emit carbon dioxide, and the liable parties (usually CO2-intensive industries and power utilities) must trade and submit enough permits to ‘cover’ their emissions. This market-based mechanism incentivises companies to increase their energy efficiency, by either reducing use or by sourcing a greater proportion of their electricity from renewables.

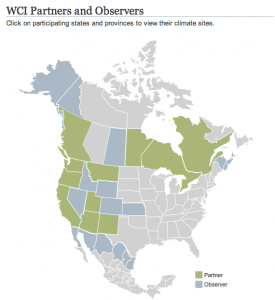

There is one mandatory ETS currently in effect in the US: The North Regional Greenhouse Gas Initiative (RGGI) (figure 7), which is an agreement between 10 Northeast and Mid-Atlantic States (Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island and Vermont). There are also two more mandatory ETSs set to start trading in 2012: The Western Climate Initiative (WCI) (figure 6), a pan-North-American ETS with 27 ‘partners’ and ‘observers’ across the US, Canada, and Mexico, and the Midwestern Greenhouse Gas Reduction Accord (Midwestern Accord) (site currently down? figure 8), in which there are 11 partners and observers across the US and Canada.

What states are leading the solar power march–and why?

In just the year 2010, 16 states each installed 10MW or more for the first time, according the the Solar Insight report. New Jersey became the first state besides California to install more than 100MW in a single year. This is a significant development, considering that, for the past few decades, California has been the uncontested leader in photovoltaics, with an 80% market share, but more recently a number of the northeast and mid-Atlantic states begun to show some muscle, stealing a bit of the Golden State’s thunder. California’s market share is now down to just 30%. The number two spot has gone to New Jersey (see table 4), which installed 137.1MW of solar in 2010, far ahead of the much sunnier, although much less densely populated 3rd-place, Nevada, with 61.4MW. What has happened to make the most successful states so successful?

The top 2 solar states: What are they doing right?

Sunny California: Small-scale, large-scale, medium-scale solar power systems

California is the home of Silicon Valley–named for the same material that most residential photovoltaic solar panels are made of. So perhaps it is not a surprise that so many leading PV manufacturers are located in the state, and that it has the highest capacity of solar power capacity in the nation. California is by virtue of its diversity, innovative capacity, and forward-thinking residents almost always ahead of the curve on environmental legislation and initiatives in the US–from energy efficiency to building standards to automobile emissions regulations. Renewables and solar power are no exception. In keeping with its trend-setting reputation, the state’s RPS mandates 33% renewable energy by the year 2020, the most ambitious in the country. 2010 saw about 260MW of solar PV installed in California.

It is difficult to summarise the incredible number of initiatives currently underway in California: there are over 100 utility rebate programs for different regions and through different utilities in the state, 8 state-wide rebate programs, numerous state-wide grant and loan programs, green building incentives, one state-wide feed-in tariff (plus one regional and one utility) not to mention a slew of regulations and standards for the state.

With generally reliable sunny weather and vast swathes of drylands/desert, California has a nearly ideal environment for solar power. In addition to the decentralised, grid-connected rooftop solar systems, California is also home to one of the top-50 largest solar photovoltaic plants in the world (in Blythe, at 21MW), and is set to be home to two other massive solar concentrating plants: 1GW of concentrating solar power, also in Blythe, and the much-talked-about Ivanpah solar power tower generation station (which has recently hit a bit of a snag because of its potential impact on the desert tortoise population in the area.) According to an article in The Economist, however, California looks likely to see a decline in the number of monument-sized plants, with the focus shifting to more dispersed, medium-scale ones, as the hurdles associated with medium-scale systems may be less problematic in this respect.

New Jersey: SREC and rebates make solar power affordable

The New Jersey solar power market has been driven to a large degree by its Solar Renewable Energy Credit (SREC) program, complemented by a number of other programs: rebates, loan programs, and other performance-based incentives. The NJ state RPS target is 22.5% renewable energy generation by 2021. New Jersey was described by SEIA’s Mr Resch as ‘no doubt’ leading the way, with a robust and healthy solar power market, full of promise for the future.

Those familiar with the Australian Renewable Energy Program (REC) program will know that the Australian government issues one REC for each megaWatt-hour of renewable energy generated by a residential solar power system up front, that is, before the system is installed and before producing even a Watt-hour of power. Australian RECs are calculated over the lifetime of the system, a nominal 15 years. In the New Jersey scheme, however, SRECs are created after 1kw-hour of power is generated–there is therefore an ongoing incentive for the system owner to produce, and the NJ government is better able to calculate the actual amount of solar power that is produced in the state. (There are no ‘phantom SRECs’, such as the ‘phantom RECs‘ that have arisen in the Australian scheme with the REC multiplier.) NJ SRECs, like Australian RECs, are bought and sold on a market, and their price fluctuates (n.b. prices on the charts on the website are in MWh; divide by 1000 to convert to kWh). Systems, once installed, are eligible to generate SRECs for 15 years. In effect, the SREC system is something like a hybrid REC-feed-in tariff system, with a variable price for each kWh generated. To complement the NJ SREC scheme a similar, although more broadly-targeted renewables incentive scheme with more up-front financing–the Grid-Connected Renwables Scheme–is also in place to encourage larger-scale projects, including wind, solar, and biomass.

Where are things headed?

The US loves markets: they are, after all, the basis for the US economy, and the US is the world’s most vocal proponent of free markets. Both state and federal governments are therefore doing what they can to let the markets do the footwork. The uptick in production worldwide is creating economies of scale, and solar systems are becoming increasingly affordable. According to the Solar Insight 2010 report, the US weighted-average system prices decreased by 20.5% over the course of 2010, down to $5.13 per Watt from $6.45 per Watt, although part of that decline is attributable to a number of large-scale utility systems that were installed in the fourth quarter of the financial year. In any case, this is part of the overal gradual trend towards more efficient solar technology and cheaper systems, offering encouragement to those who would like to see solar power and other renewables take up a bigger proportion of the world’s energy production.

Interestingly, when asked if he thought the US PV market would be the biggest in the next few years, SEIA’s Mr Resch responded enthusiastically, “Without a doubt!” going to further to say that the US may even take the crown from Germany as soon as the year 2013. And if the industry is booming in the US, which does not have the same sort of federal government intervention that has been seen in Australia and Germany, that means it is truly booming.

Written by James Martin

Solar Choice Analyst

© 2010 Solar Choice Pty Ltd

Sources and Links:

DSIRE (Database of State Incentives for Renewables and Efficiency) — Well-organised database for US renewable energy and energy efficiency policy

Pew Center on Climate Change, “Who’s winning the clean energy race” (pdf)

GTM Research, “Solar Market Insight: 2010 Year in Review”

New Jersey Clean Energy Website

Miller-McCune, “Are the new solar power projects anti-environmental?”

PACE, “Australia moves up the ranks in clean energy investment”

USA Today, “California sets highest green power goal”

Southern California Public Radio, “$30 million DPW solar panel program has $175 worth of demand”

LA Times, “California renewable energy gets major boost in new law”

Examiner, “Riz Khan – The US and the Green Battle”

The Economist, “Desert Dawn – some solar plants need to be big, most of them don’t”

RenewableEnergyWorld.com, “Watch out California, here comes the rest of the US” (Excellent videos with solar power business experts)

VentureBeat.com, “Dust, turtles threaten BrightSources $250m IPO”

Newcity.Patch.com, “SRECS will help us reduce our reliance on Indian Point (nuclear facility)”

Reuters, “PV boosts the sales price of California homes”

Previous related Solar Choice Blog Entries: EUr’Observer reports and Germany : Solar update from Germany : 2010: an extraordinary year for Australian solar power : Australia’s Enhanced Renewable Energy Target (eRET) : STCs and RECs – need for price stability (SMH) : Australian state-by-state Feed-in Tariffs : Australian ETS voted down in senate for second time : How will a price on carbon affect the solar power market? : Changes to the eRET : The ever-improving PV technology dilemma – should I wait to buy my solar power system?

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

- Enphase Battery: An Independent Review by Solar Choice - 20 January, 2024

- Can I add more panels to my existing solar system? - 8 August, 2023